Revitalizing Heber City's Downtown

Community Reinvestment Agency (CRA)

FAQ

A Community Redevelopment Agency, or CRA, is a municipal financing tool for improving specifically designated areas in a community.

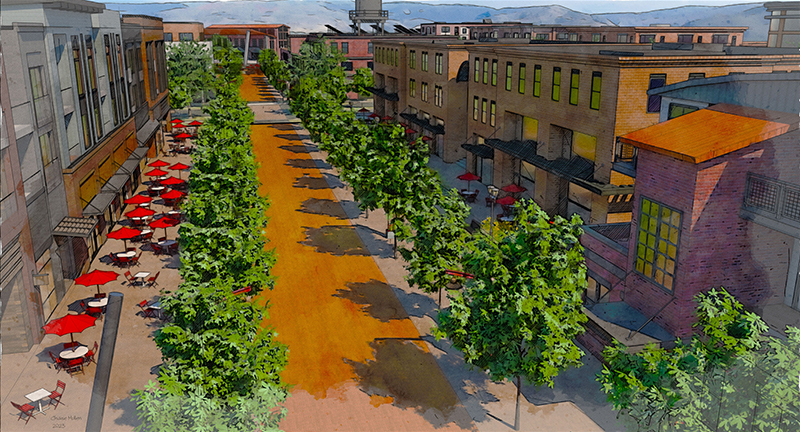

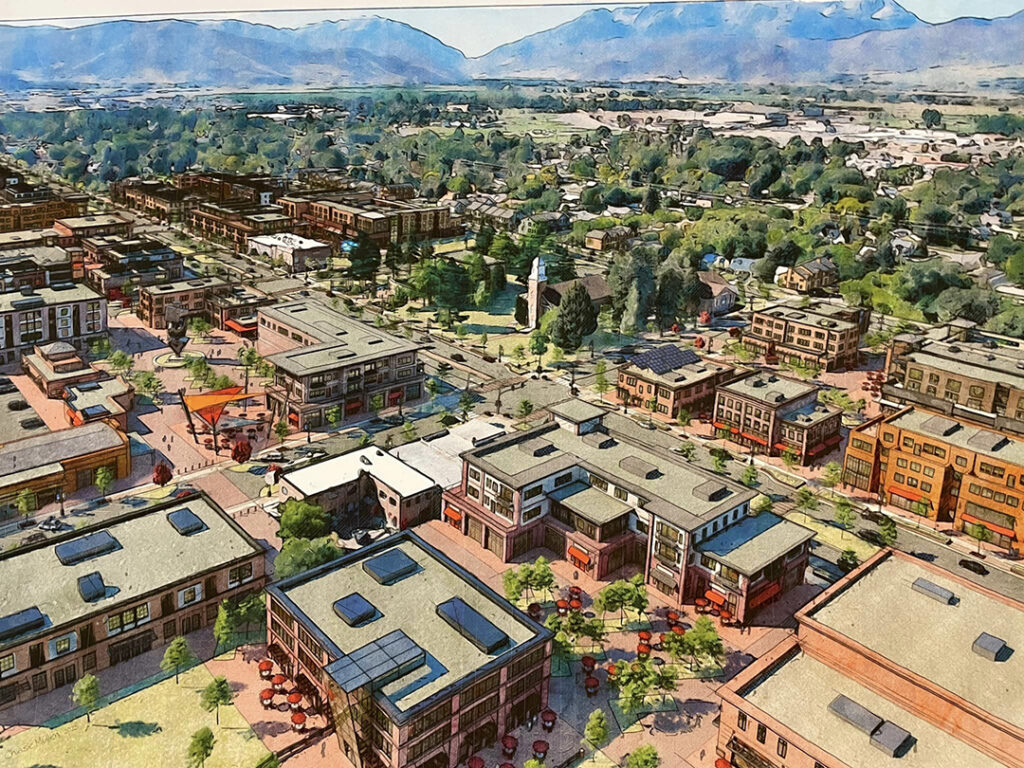

Extensive public outreach during the Envision Central Heber initiative revealed the community’s vision for downtown Heber City. The Utah legislature provides the CRA as a tool for municipalities to reinvest in areas with failing infrastructure or aging districts. CRAs have been utilized by many local governments in the state of Utah with great success. Establishing a CRA for downtown Heber City will enable us to realize the public’s vision, including landscaping, aesthetic improvements, parking solutions, better infrastructure, a more walkable downtown, and enhanced shopping, dining, and entertainment opportunities.

The Community Redevelopment Agency will be overseen by the Heber City Council, which will serve as the Agency Board. Wasatch County and the Wasatch County School District will each have representatives on a subcommittee that will advise and consult with the Heber City Council regarding all things CRA-related.

- The CRA has a fixed boundary in downtown Heber City (see map Heber City CRA Map). Funds are only collected and reinvested within the boundary. If you do not live within the boundary, you will not be affected by the Downtown Heber CRA.

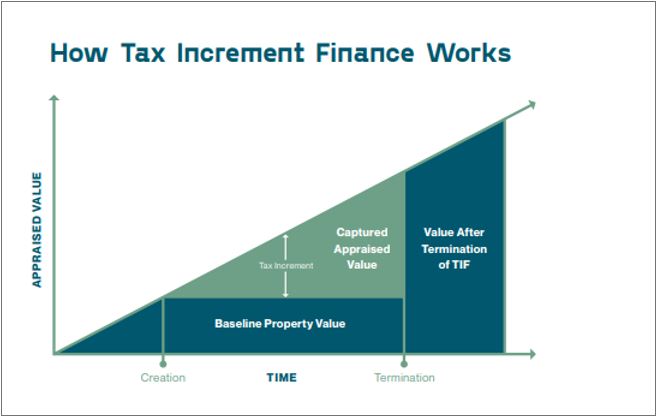

- The base property taxes that have historically been collected by Wasatch County and Wasatch County School District will remain intact. Funding is created as reinvestment within the boundary increases the value of those properties. Both Wasatch County and Wasatch County School District will receive a portion of the increment as it grows throughout the agency’s lifespan.

No. According to the Utah State Code, the CRA Agency Board must consist of the legislative body that established the Agency. However, by creating a CRA Advisory Committee to work with the Agency Board, both the WCSD Board and WC Council may have a voice in how CRA funds are spent.

Utah Code:

17C-1-102 Definitions.

As used in this title:

(15) “Community” means a country or municipality.

17C-1-203. Agency board — Quorum.

(1) The governing body of an agency is a board consisting of the current members of the community legislative body.

The CRA will not impact schoolchildren, first responders, or other property tax beneficiaries. Wasatch County and Wasatch County School District will continue to receive the base property tax historically generated within the CRA boundary.

The Downtown Heber CRA zone is predominantly commercial, and many properties have not seen notable improvements in a generation or more. As reinvestment occurs, aged commercial properties will increase in value, of which Wasatch County and Wasatch County School District will receive annual percentages of that incremental growth. At the end of the 20-year term of the Downtown Heber CRA, the incentivized commercial improvements will create revenues for the beneficiaries of property taxes that history suggests may not have happened otherwise.

The Downtown Heber CRA is not a percentage increase on Wasatch County property tax and does not affect properties outside the boundary. When a specific property is improved within the CRA boundary, the tax assessment after project completion will reflect that improvement. The difference between the before-and-after property valuation creates the increment to be reinvested within the CRA boundary, which is predominantly commercial.

The tax increment that the CRA will generate will be spent on several important initiatives. First and foremost, funds would be spent on infrastructure needed to support the reinvestment in downtown, such as waterlines, sewer lines, stormwater drainage, and roads. It will also be spent on parking solutions to make the downtown experience more accessible.

Local businesses may also benefit from grant programs managed by the CRA Subcommittee and the Agency Board.

Investment in downtown Heber City will attract opportunity, business, and traffic. However, that traffic will likely park and stay for a while instead of following the current traffic patterns of passing through to get somewhere else. The citizens’ idyllic vision for Downtown Heber, per the Envision Central Heber initiative, is to make it a destination where the community can visit, park, and enjoy the events, activities, and amenities a vibrant downtown district could offer.

This is based on data available in October 2023. Not all agencies have reported their active project areas.

American Fork (3), Beaver (9), Bluffdale (3), Bountiful (1), Box Elder County (3), Brian Head, Brigham City (5), Cache County (1), Carbon County, Cedar City (3), Centerville (3), Clearfield (8), Clinton, Coalville, Cottonwood Heights (1), Daggett County, Draper (4), Eagle Mountain (4), Elwood, Ephraim, Fairview, Farmington (2), Fillmore, Garden City, Garland City, Grantsville, Helper, Herriman (4), Holladay (2), Hurricane (1), Iron County (13), Ivins, Kane County, Kaysville, Layton (2), Lehi (7), Lindon (2), Logan, Midvale (3), Midway, Millard County, Millcreek (2), Moab, Morgan City (1), Mt. Pleasant, Murray (5), Naples, Nibley (1), North Logan, North Salt Lake (3), North Ogden, Ogden, Orem (2), Park City (1), Payson, Perry (1), Plain City, Pleasant Grove (4), Pleasant View (1), Price, Provo (2), Riverdale (1), Riverton (1), Roosevelt, Roy (2), Salem, Salina (1), Salt Lake City (11), Salt Lake County (2), Sandy (6), Santa Clara, Santaquin, Saratoga Springs (1), Sevier County (1), Smithfield, South Jordan (6), South Ogden (2), South Salt Lake (2), Spanish Fork (2), Springville, St. George (5), Summit County, Sunset, Syracuse (3), Taylorsville (3), Toole (1), Tooele County (4), Tremonton (1), Vernal, Vineyard (1), Washington Terrace, Weber County (1), Wellington, Wendover, West Bountiful (2), West Jordan (6), West Point (1), West Valley, Woods Cross.

CRA Projected Projects and Outlay

Land Acquisition

Parking Improvements

Downtown (Supportive) Infrastructure Improvements

Buildings & Amenities

Planning

How Does it Work?

Utah state legislation grants certain powers to local government to create redevelopment agencies to facilitate new development and redevelopment of targeted areas. This tool is currently called a “Community Reinvestment Area (CRA)” and involves using a portion of the property tax revenues (known as “tax increment”) generated by the renewal of the area to finance eligible redevelopment activities. Tax increment financing is a useful tool available in project areas to support redevelopment and can be used to offset certain costs incurred to implement a redevelopment plan. These include property acquisition, infrastructure improvements, demolition, support of specific uses, etc.

More Information

All information provided on this website is current as of October 15, 2024. Please note that the documents and content within this page are subject to change without notice. We make every effort to ensure the accuracy and reliability of the information presented. Users are encouraged to verify any information before making decisions based on it. Thank you for your understanding.