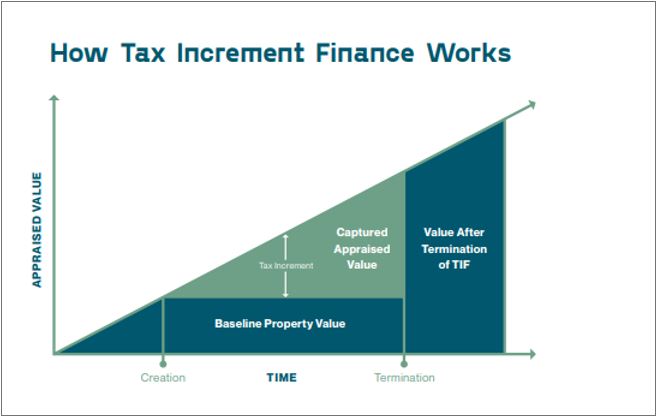

Utah state legislation grants certain powers to local government to create redevelopment agencies to facilitate new development and redevelopment of targeted areas. This tool is currently called a “Community Reinvestment Area (CRA)” and involves using a portion of the property tax revenues (known as “tax increment”) generated by the renewal of the area to finance eligible redevelopment activities. Tax increment financing is a useful tool available in project areas to support redevelopment and can be used to offset certain costs incurred to implement a redevelopment plan. These include property acquisition, infrastructure improvements, demolition, support of specific uses, etc.

A redevelopment agency will administer the CRA and is comprised of the City Council. Some cities also elect to have a separate board which helps determine appropriate investments for tax increment. CRAs are helpful tools, including offering the following abilities:

An effective CRA requires the participation of the taxing entities that have taxing authority within the defined area. These entities continue to receive base taxes (taxes that are existing prior to creation of a CRA), as well as a negotiated portion of the generated increment. At the end of the CRA life (typically near 20 years), taxes return to the entities in full. All generated tax increment is required to be spent within the defined project area.